Navigate Your Online Income Tax Return in Australia: Essential Resources and Tips

Browsing the online tax return process in Australia needs a clear understanding of your commitments and the sources readily available to improve the experience. Important files, such as your Tax Obligation File Number and revenue declarations, should be diligently prepared. Picking an ideal online platform can considerably impact the performance of your declaring process.

Understanding Tax Obligation Responsibilities

Understanding tax obligation responsibilities is essential for people and organizations operating in Australia. The Australian taxes system is regulated by numerous laws and laws that require taxpayers to be knowledgeable about their obligations. Individuals have to report their revenue properly, which includes incomes, rental income, and investment profits, and pay taxes as necessary. Additionally, residents have to recognize the difference between taxable and non-taxable income to make sure compliance and maximize tax obligation results.

For organizations, tax commitments include several aspects, consisting of the Goods and Services Tax Obligation (GST), firm tax obligation, and pay-roll tax obligation. It is crucial for organizations to register for an Australian Organization Number (ABN) and, if suitable, GST enrollment. These obligations demand careful record-keeping and prompt submissions of income tax return.

In addition, taxpayers need to know with offered deductions and offsets that can minimize their tax worry. Seeking advice from tax obligation experts can offer beneficial understandings right into maximizing tax positions while guaranteeing conformity with the regulation. On the whole, a detailed understanding of tax obligation obligations is important for reliable financial planning and to stay clear of charges related to non-compliance in Australia.

Essential Papers to Prepare

In addition, compile any type of pertinent financial institution declarations that mirror interest income, as well as reward statements if you hold shares. If you have other income sources, such as rental buildings or freelance work, ensure you have documents of these earnings and any associated costs.

Do not fail to remember to include deductions for which you may be eligible. This could include invoices for job-related expenditures, education and learning prices, or philanthropic donations. Lastly, take into consideration any private health and wellness insurance policy statements, as these can impact your tax obligation commitments. By gathering these crucial documents beforehand, you will streamline your on the internet tax obligation return procedure, minimize errors, and make the most of potential refunds.

Choosing the Right Online Platform

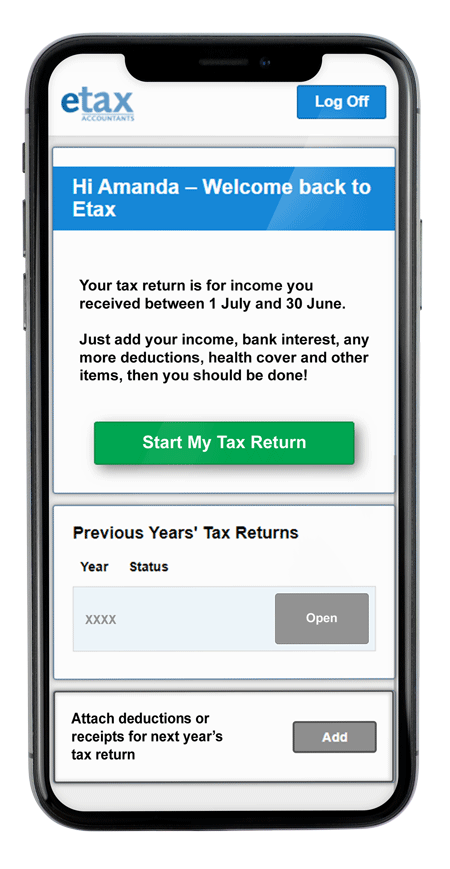

As you prepare to submit your on-line income tax return in Australia, selecting the appropriate platform is necessary to make certain precision and convenience of usage. A number of vital factors should lead your decision-making process. Initially, consider the system's interface. A simple, intuitive layout can considerably boost your experience, making it easier to navigate complex tax kinds.

Next, evaluate the system's compatibility with your financial circumstance. Some solutions provide especially to people with easy tax returns, while others give extensive assistance for more intricate circumstances, such as self-employment or investment income. Moreover, look for systems that use real-time error checking and assistance, aiding to lessen blunders and making sure conformity with Australian tax obligation regulations.

One more essential element to consider is the level of client assistance offered. Dependable platforms need to provide access to support by means of e-mail, phone, or conversation, particularly throughout top declaring periods. In addition, research individual testimonials and rankings to evaluate the general contentment and integrity of the system.

Tips for a Smooth Filing Process

Filing your on-line tax return can be a simple procedure if you adhere to a few essential ideas to make certain efficiency and accuracy. This includes your earnings declarations, invoices for reductions, and any other appropriate documents.

Following, make use of the pre-filling attribute offered by numerous online systems. This can save time and lower the chance of errors by instantly occupying your return with details from previous years and information provided by your employer and banks.

Furthermore, verify all access for precision. online tax return in Australia. Blunders can bring about postponed reimbursements or concerns with the Australian Taxes Office (ATO) See to it that your personal details, revenue numbers, and reductions are proper

Declaring early not only minimizes tension but additionally allows for far better planning if you owe taxes. By following these pointers, you can navigate the on-line tax return procedure smoothly and with confidence.

Resources for Help and Support

Navigating the intricacies of on the internet tax obligation returns can often be complicated, but a selection of resources for help and support are easily offered to assist taxpayers. The Australian Taxes Office (ATO) is the main resource of information, supplying extensive overviews on its website, consisting of Frequently asked questions, instructional video clips, and live conversation options for real-time aid.

Additionally, the ATO's phone assistance line is readily available for those who like straight communication. online tax return in Australia. Tax specialists, such as registered tax representatives, can additionally provide tailored assistance and make sure conformity with present tax obligation regulations

Conclusion

Finally, efficiently browsing the on-line tax obligation return procedure in Australia calls for an extensive understanding of tax responsibilities, careful prep work of necessary records, and mindful option of an ideal online system. Abiding by functional try this out ideas can improve the filing experience, while available resources offer valuable assistance. By coming close to the procedure with persistance and interest to detail, taxpayers can guarantee compliance and optimize prospective benefits, ultimately adding to an extra effective and successful tax obligation return result.

As you prepare to submit your online tax obligation return in Australia, selecting the ideal platform is crucial to make sure accuracy and simplicity of use.In final thought, properly browsing the on-line tax return procedure in Australia requires a thorough understanding of tax obligation obligations, meticulous prep work of crucial records, and cautious selection of a suitable online platform.